As we enjoy our Summer holidays and vacation time it paints a picture of the idyllic retirement some of us hope to achieve. Retirement is different for everybody, so take a look at the questions we’ve assembled to get an idea of some things worth considering.

What should a retirement budget depend on? Largely, lifestyle. Take a look at the questions we’ve assembled below to get an idea of some things worth considering:

WHAT DO YOUR DAY TO DAY EXPENSES LOOK LIKE?

Having an idea of what is being spent monthly on things like groceries, the cable bill, clothing and things like entertainment is important. Tracking these expenses will give you an indication of what your annual costs look like.

WILL YOU BE DRIVING MORE OR LESS?

For some, eliminating one car along with its associated insurance in tandem with eliminating work commutes can lead to lower overall transportation costs.

WHAT TYPE OF VACATIONER ARE YOU?

For some, it could be taking the RV through the Okanagan during the Summer months while for others it could be cruising five times a year. Having an approximate annual dollar amount is paramount to the planning process. Do keep in mind, though, that most travelling happens in the earlier retirement years so if you’re estimating that you’ll be spending $20,000 annually on travelling costs, that number will most likely decline as time goes on.

DO YOU HAVE OR PLAN ON BEGINNING ANY EXPENSIVE HOBBIES?

A membership at a Yacht Club or golfing three times a week can add up significantly and it’s important to factor in these costs.

DO YOU PLAN ON CONTINUING TO WORK IN SOME CAPACITY?

More and more we hear about retirement occurring in phases and initially, most don’t want to leave the workforce entirely. If you can find something you love while bringing in some extra cash, that’s a win-win.

WHAT ARE YOUR RETIREMENT HOUSING PLANS?

Are you already settled into your retirement home, do you plan on downsizing the family home? These decisions could lead to more cash inflows or more outflows.

The above list, although not exhaustive by any means, can hopefully provide a ballpark figure of how much income you could need in retirement.

In terms of funding for retirement, there are various sources of income you can look to including government benefits in the form of CPP and OAS. Understanding how much you are entitled to receive from these benefits is critical to determine where any monthly cashflow shortfalls may be. Also, early recognition that OAS begins to experience clawbacks once taxable income hits $73,756 can help individuals and couples plan how they receive income throughout their retirement years.

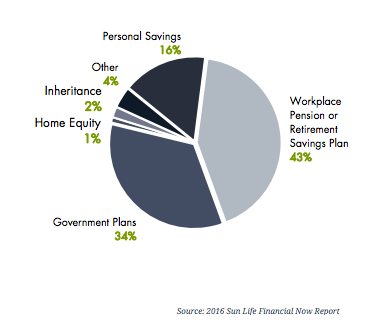

Beyond that, most will have additional savings. This could be in the form of some sort of work pension or perhaps through other vehicles such as RRSP’s or other investment accounts. Some may have cash flow from rental properties and for many, equity in the home will come into play as well with the option of downsizing. The chart to the right is an illustration showing where many retirees source their income in retirement.

So how do you reconcile your income goals with what you have or can expect to have in the future with so many unknowns?

Keep in mind that things can and do change so if you’re already realizing you may not have enough saved, don’t panic just yet. Many times, there are other factors that could come into play including possibly working longer, receiving an inheritance and often, downsizing the family home. There are many options to be explored, the key is to be flexible and remember that it’s never too early to start the planning process.