One of the most common questions we get is “How much money do I need to retire?”, and the truth is, the answer is different for everyone. Your lifestyle, age, debts, and future goals all play a part in shaping how much you’ll need. But that doesn’t mean it has to be complicated. With the right planning and a clear picture of your future, it’s possible to retire comfortably, even without a pension—how? We’ll break it down further below.

What Factors Determine How Much You’ll Need?

To get a sense of what your retirement number looks like, ask yourself:

-

Will I still have debts to pay off when I retire?

-

Do I plan to financially support children or aging parents?

-

Do I have a workplace pension?

-

What kind of lifestyle do I want in retirement — quiet and local, or full of travel and hobbies?

Once you know your ideal retirement lifestyle, you can start to map out how much money you’ll actually need to support it.

The 70% Rule (And Why it Works)

A common guideline is that you'll need about 70% to 80% of your pre-retirement income each year once you stop working. That’s because some expenses, like commuting or work-related costs, will likely decrease in retirement. For example, if you’re currently earning $100,000 per year, you’ll want to aim for a retirement income of around $70,000 to $80,000 annually.

That said, everyone’s situation is different. You may need more or less depending on your monthly spending and future plans.

How Much Should You Aim to Save?

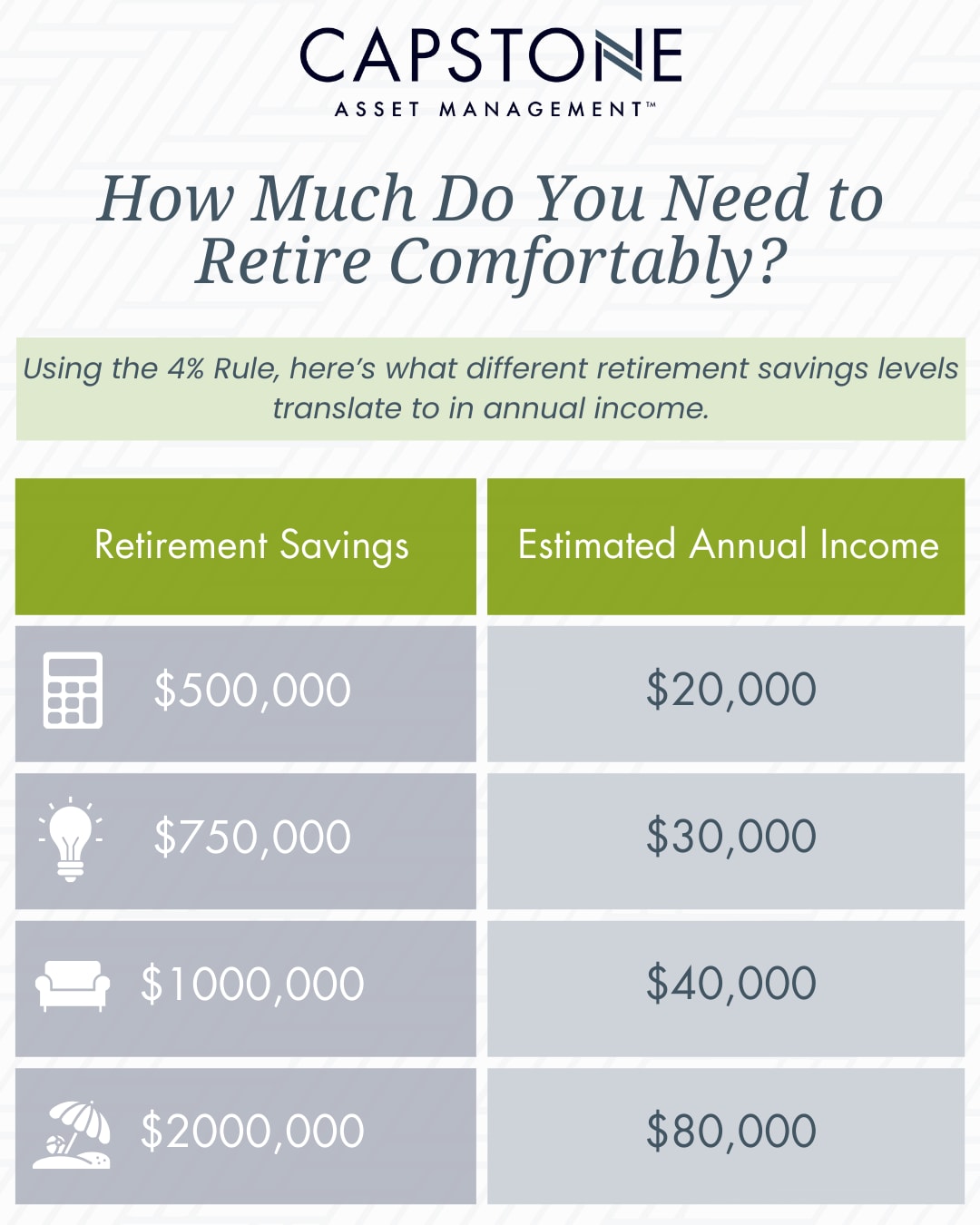

We usually recommend planning for at least $750,000 in retirement savings, especially if you don’t have a pension. Here’s a simple breakdown of how different savings levels translate to annual income (based on the “4% rule,” which suggests withdrawing 4% of your retirement savings per year):

As you can see, retiring on $500,000 is technically possible, but it might be tight depending on where you live and what your expenses look like. If you want more flexibility, $1 million or more offers a more comfortable cushion.

When Should You Start Saving?

Short answer: as early as possible. Even if retirement feels like a long way off, starting early gives your money more time to grow thanks to the power of compounding. We recommend aiming to save at least 10% of your annual income toward retirement. You can use tools like:

-

RRSPs – Contributions reduce your taxable income and grow tax-deferred

-

TFSAs – Great for tax-free investment growth and flexible withdrawals

-

Mutual Funds & Stocks – Depending on your risk tolerance and time horizon

Even if you have a workplace pension, building personal savings can make retirement less stressful and give you more freedom down the road.

Don’t Forget About Government Benefits

CPP, OAS, and other government programs may provide a helpful base layer of income in retirement. But for most Canadians, they aren’t enough to fully fund retirement on their own, which is why building your own savings strategy is so important.

What If I Need to Use the Principal?

Many people aim to leave their retirement savings untouched and only live off the interest or investment income. That’s great if it’s possible, but it’s also okay to start drawing down the principal once you’ve stopped working, especially if passing on an inheritance isn’t your top priority.

Planning for retirement isn’t just about picking a number, it’s about designing the lifestyle you want and taking proactive steps to fund it. Whether you’re just starting out or getting closer to retirement age, having a savings and investment plan that fits your life is key. Need help figuring out what that looks like for you? Reach out to us, our team at Capstone is here to guide you through it.

.jpeg)