Impact investing has rapidly gained traction in recent years as more investors seek to align their financial goals with their personal values. This approach goes beyond traditional investing by intentionally directing capital toward projects and businesses that generate measurable social and environmental outcomes, alongside a financial return.

What Is Impact Investing?

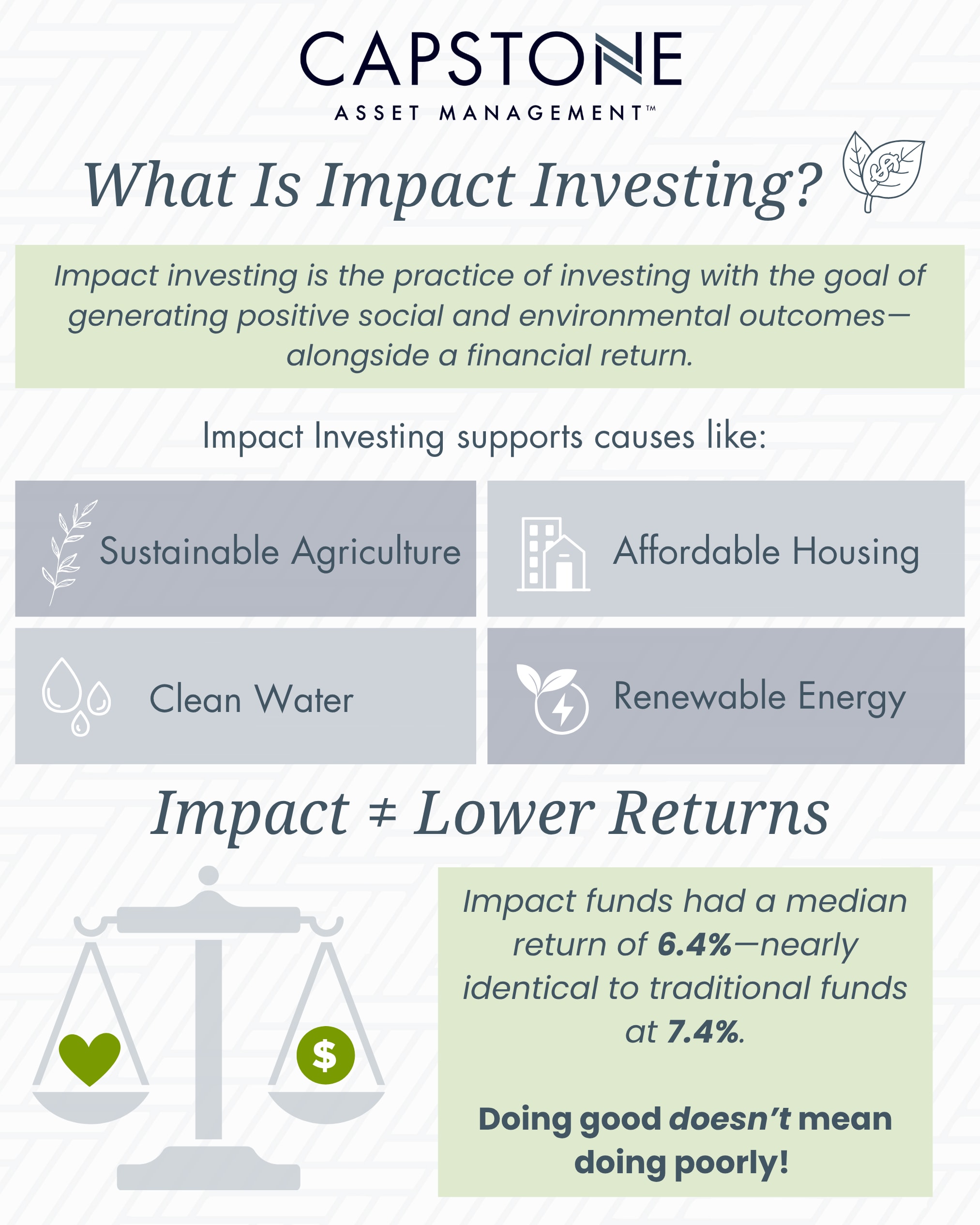

Impact investing is defined as investing with the intention to generate positive, measurable social and environmental impact while also achieving a financial return. These investments span both emerging and developed markets and target critical areas such as:

-

Affordable housing

-

Clean energy

-

Sustainable agriculture

-

Healthcare

-

Education

-

Water access

-

Economic development in underserved communities

Rather than donating to charitable causes or settling for below-market returns, impact investors can contribute to meaningful global change while still pursuing financial growth.

A Market on the Rise

The momentum behind impact investing has been significant. By the end of 2021, the private impact investing market had reached approximately $1.2 trillion, a 63% increase since 2019. And yet, this figure still represents just a portion of the capital needed to drive real global change. The United Nations estimates a $4.3 trillion annual funding gap in achieving the Sustainable Development Goals (SDGs) by 2030. These goals cover everything from clean energy to quality education and economic equality.

In response, institutional investors and private individuals alike are increasingly recognizing their role in bridging this gap, without sacrificing the long-term value of their investments.

Performance vs. Purpose: A False Trade-Off?

One common concern about impact investing is the belief that pursuing positive impact must come at the expense of strong returns. However, data suggests that’s not necessarily the case. A 2022 academic study comparing impact and non-impact funds found that their median internal rates of return were similar—6.4% for impact funds compared to 7.4% for non-impact-seeking funds.

While underperformance can occur, it is often tied to execution or market conditions, rather than the nature of the investment itself. Like any other asset class, impact investments require thoughtful selection, proper due diligence, and strong management.

Barriers to Entry Still Exist

Despite growing interest, some barriers continue to prevent wider adoption. These include:

-

High minimum investment thresholds

-

Longer lock-up periods

-

Limited investor education or access to opportunities

As the industry matures and more accessible impact products become available, it's expected that these limitations will ease over time, allowing a broader range of investors to participate.

Capstone’s Approach to Impact

At Capstone Asset Management, our goal is to offer investment solutions that help clients grow their wealth while making a tangible difference in the world. Two funds launched in 2024 reflect this mission:

The Capstone Kinvest Impact Fund: Focused on empowering entrepreneurs in Rwanda through sustainable agriculture. The fund supports farmland acquisition, training, and export capacity, creating long-term, community-based economic engines.

The Capstone Stewardship Extension Fund: Provides mortgage financing to Christian organizations undertaking construction, renovation, or repurposing projects. The fund supports community-driven growth while offering an income-generating opportunity for investors.

These funds exemplify how capital can be deployed for both return and impact, without compromise.

Investing with Intent

Impact investing continues to reshape the way individuals and institutions think about their financial legacy. It’s not just about growth—it’s about making that growth matter. As the global economy shifts toward more sustainable and socially conscious priorities, investors have the opportunity to play an active role in driving that progress.

To learn more about impact investing opportunities at Capstone Asset Management, connect with our Private Wealth Team and make a difference today!

.jpeg)